》View SMM Silicon Product Prices

》Subscribe to View Historical Price Trends of SMM Metal Spot

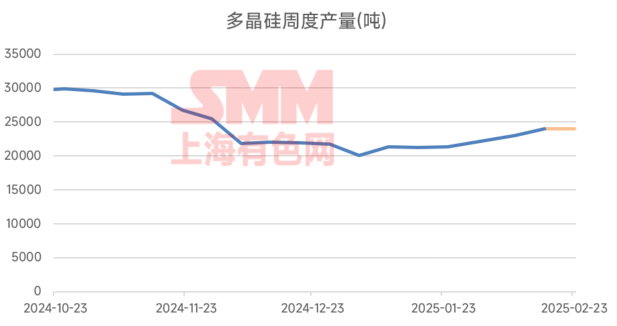

SMM, February 21: Polysilicon: In February, weekly polysilicon production showed a slight increase. During the week of 2.17-2.23, polysilicon production was estimated at 24,000 mt, up by approximately 2,000 mt compared to the same period in January. The main driver was the production expansion by some second- and third-tier polysilicon enterprises. Polysilicon product prices remained basically stable, with SMM N-type recharging polysilicon quoted at 39-45 yuan/kg. In terms of raw material procurement, some polysilicon plants conducted price inquiries and tenders over the past week, while some orders have yet to be released. Post-holiday prices for silicon powder or silicon blocks showed a slight decline compared to pre-Chinese New Year levels.

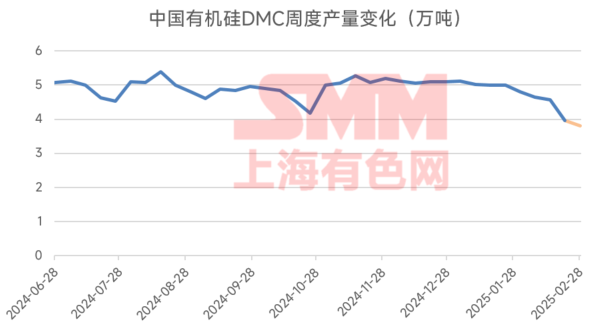

Silicone: In February, weekly silicone production gradually declined. During the week of 2.15-2.21, silicone DMC production was 39,700 mt, down by approximately 10,000 mt compared to the same period in January. The main reason was capacity maintenance at some monomer plants. February silicone production saw a significant MoM decrease, with silicon metal consumption from the silicone sector expected to drop by around 15,000 mt. SMM silicone DMC prices ranged from 13,400-13,800 yuan/mt, up by 800 yuan/mt compared to early February. This round of silicone price increases was driven by two factors: first, collective price hikes by silicone enterprises standing firm on quotes, coupled with strong demand during the minor peak season in downstream consumption; second, production cuts and maintenance by silicone enterprises led to a temporary supply reduction, jointly pushing up DMC prices. In terms of raw material procurement, silicone enterprises mainly adopted a purchasing-as-needed approach due to varying requirements for silicon blocks among enterprises, combined with significant price differences across supplier channels.

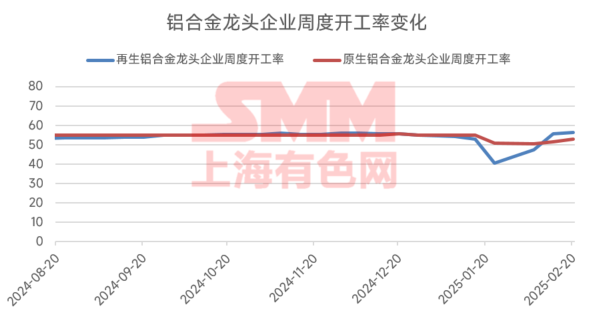

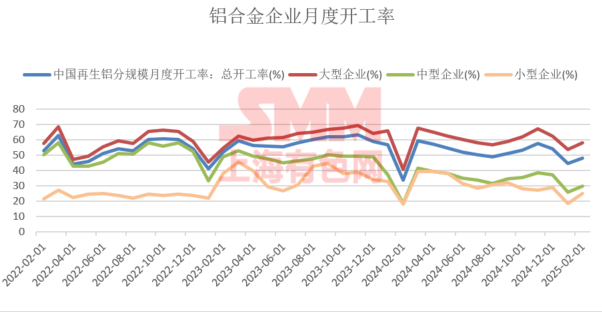

Aluminum Alloy: In February, the weekly operating rate of leading primary and secondary aluminum alloy enterprises gradually increased as production resumed after the holiday. From the perspective of operating rate changes among secondary aluminum-silicon alloy enterprises of different scales, larger enterprises generally maintained higher operating levels, with the operating rate of large enterprises consistently above the industry average. In terms of raw material procurement, some enterprises had sufficient stockpiles from pre-holiday purchases and focused on inventory consumption, while others adopted a purchasing-as-needed approach and engaged in price negotiations.

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)